Crypto Funding Rate Arbitrage Scanner

Discover profitable crypto arbitrage opportunities with our advanced funding rate scanner. Track and analyze cryptocurrency futures market funding rates effortlessly.

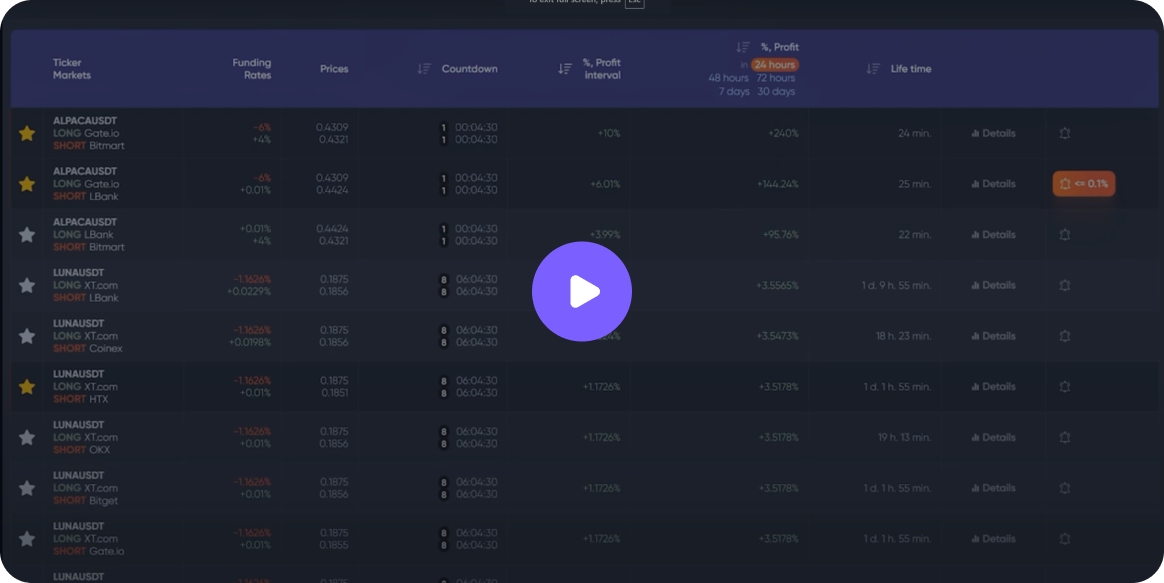

Crypto funding rate arbitrage is an exciting and lucrative strategy that is rapidly gaining popularity among traders. The new, user-friendly tool from P2P.Army provides traders with an easy way to monitor and analyze funding rates from over 15 well-known crypto exchanges, helping users take advantage of market inefficiencies.

Funding Scanner Video Review

What is a Funding Rate?

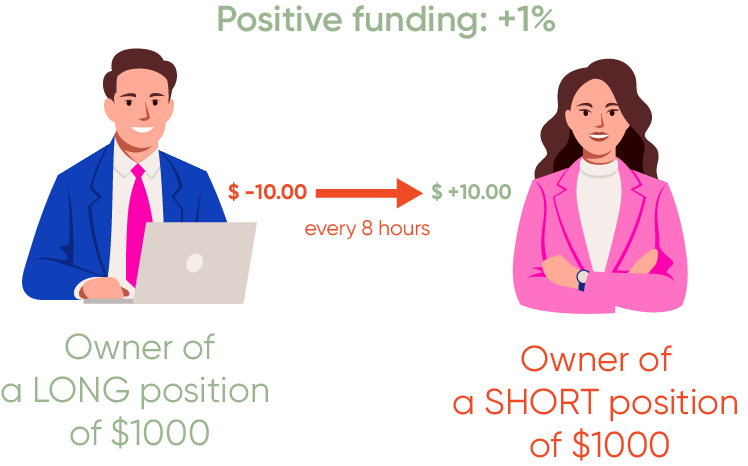

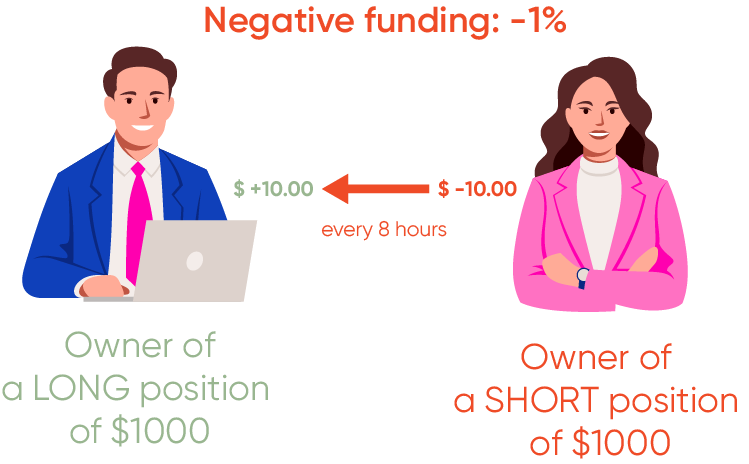

A funding rate is a recurring payment exchanged among traders who use perpetual futures contracts on cryptocurrency exchanges. This mechanism is designed to keep the perpetual futures price aligned closely with the underlying asset's spot price. Whenever the perpetual futures price significantly diverges from the spot price, the exchange incentivizes traders economically through these periodic funding payments to rebalance prices.

How Do Funding Rates Work on Futures Exchanges?

Funding payments typically occur every eight hours, although some exchanges implement them hourly or every four hours. Depending on the market conditions:

pay SHORT positions.

How Can You Earn Profit from Funding Rate Arbitrage?

The P2P.Army scanner helps traders identify arbitrage opportunities 24/7 by automatically tracking differences (or spreads) in funding rates across multiple exchanges. When traders simultaneously open opposite positions (one LONG and one SHORT) on two platforms offering different funding rates for the same cryptocurrency, they can earn reliable returns with minimal risk.

The main advantage of this arbitrage strategy is significantly reduced risk, as opposing positions offset each other's price movements. While the spread (funding rate difference) is positive, you receive payments every funding interval.

The P2P.Army scanner continuously tracks these spreads and alerts you immediately when a profitable spread disappears, allowing you time to promptly close your positions.

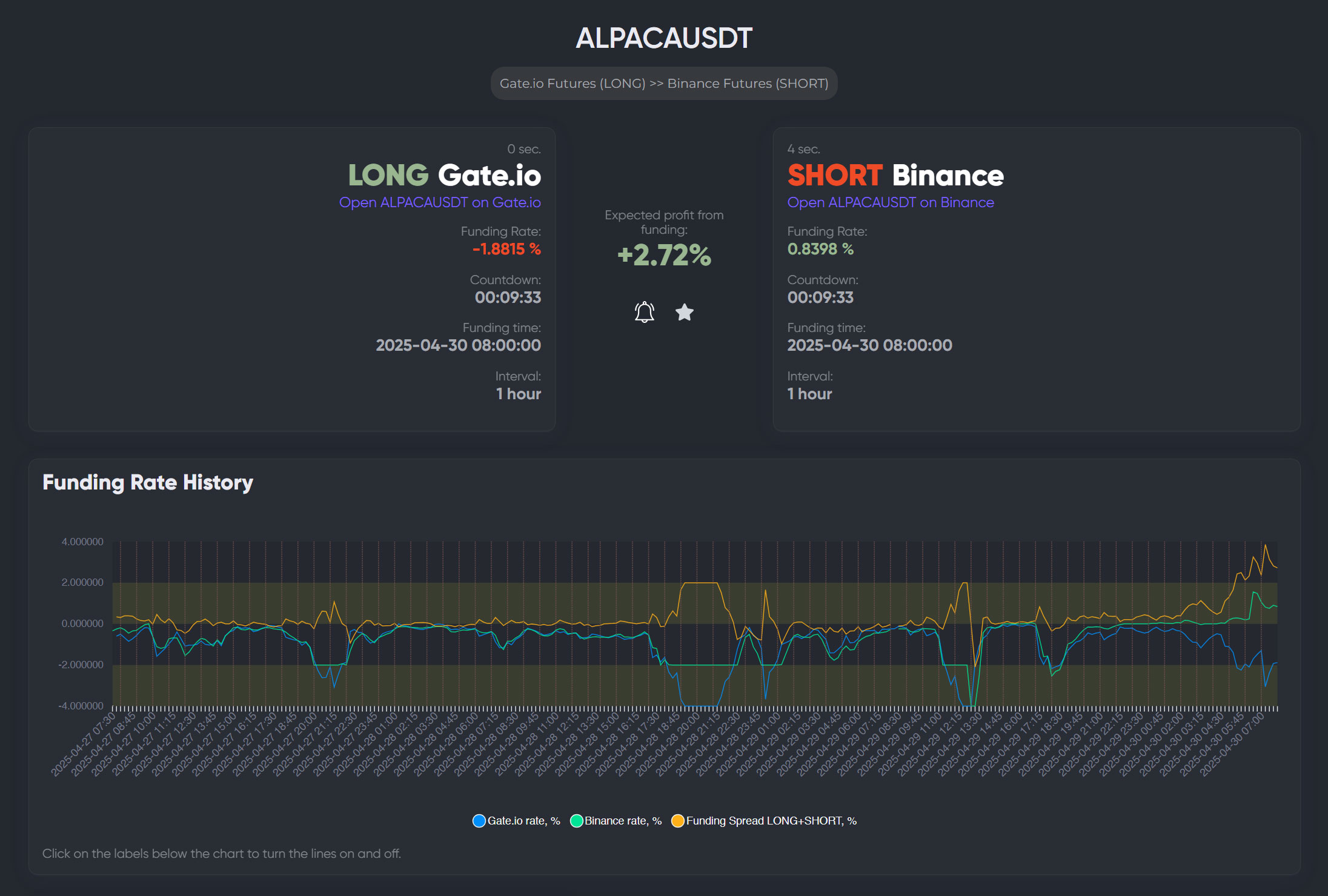

A profitable spread might last several days or even weeks. During this time, you receive funding payments every funding interval (typically every 8 hours). For example, if the spread between funding rates is +0.4811% for each 8-hour interval, you could earn +10.1042% in 7 days without leverage, assuming the spread remains consistent. With 10x leverage, this weekly return could potentially reach around +101%.

The Crypto Funding Rate Scanner from P2P.Army

The P2P.Army funding rate scanner simplifies and automates the research and detection of profitable arbitrage opportunities. Its primary function is constant market monitoring along with timely notifications to traders regarding profitable funding rate spreads.

Historical Funding Rate Data

The tool provides historical funding rates not only visually through charts but also clearly organized in tables. Tabular data is segmented by time intervals, allowing traders to easily review, analyze, and compare funding rate spreads over time to make faster, data-driven trading decisions.

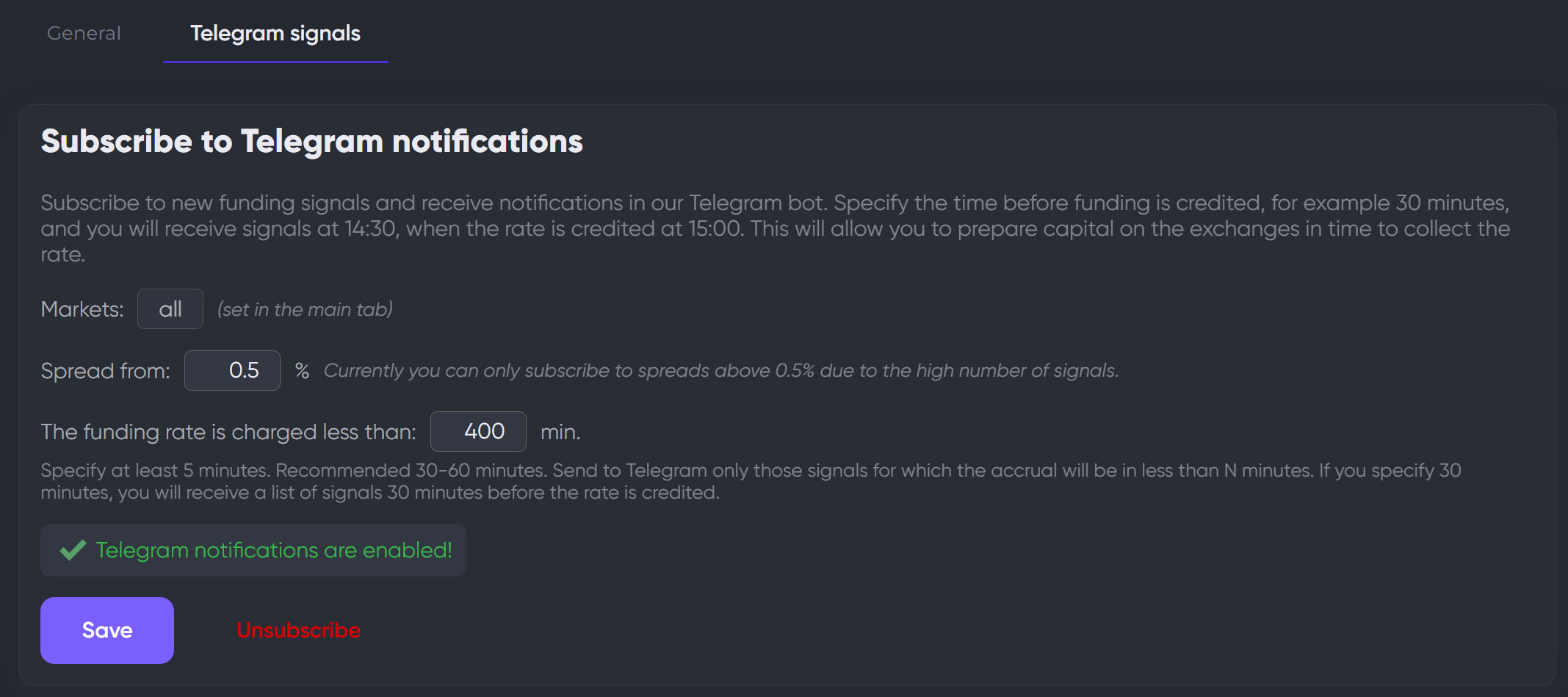

Real-Time Telegram Notifications About Funding Rates

Another helpful feature is real-time Telegram notifications that alert you ahead of new funding intervals. Traders can customize alerts to receive notifications minutes before new funding rate payments occur, enabling timely decision-making and position adjustments.

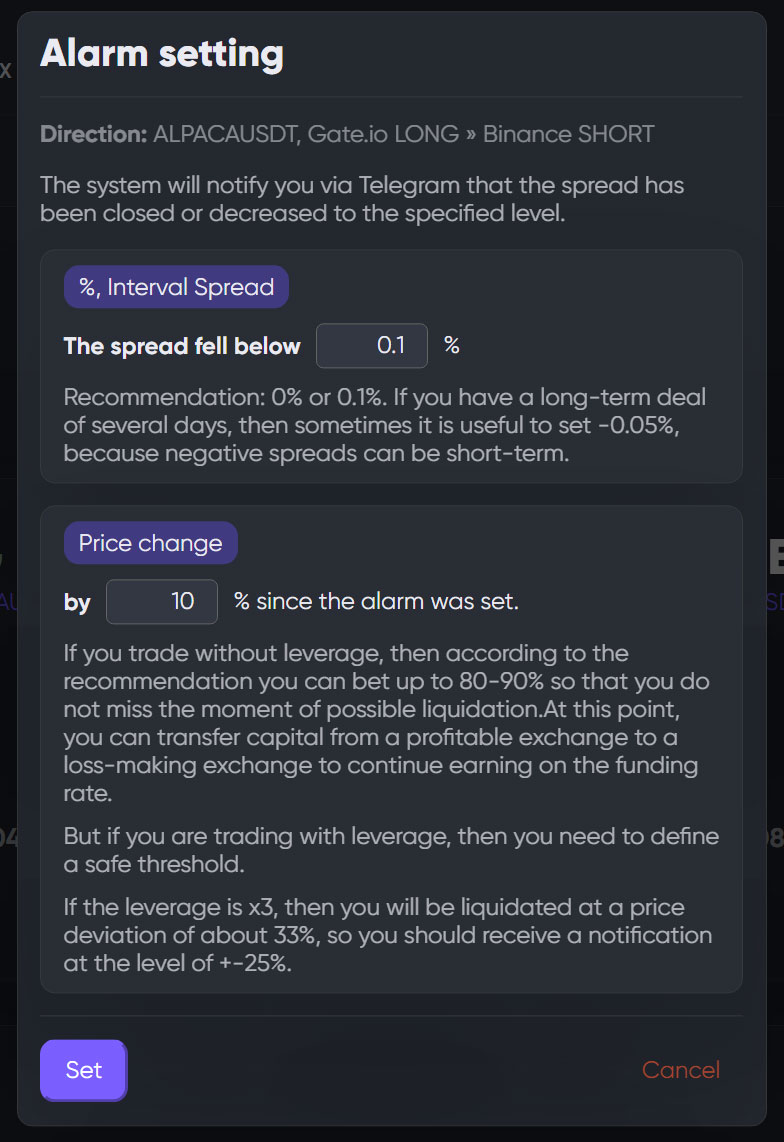

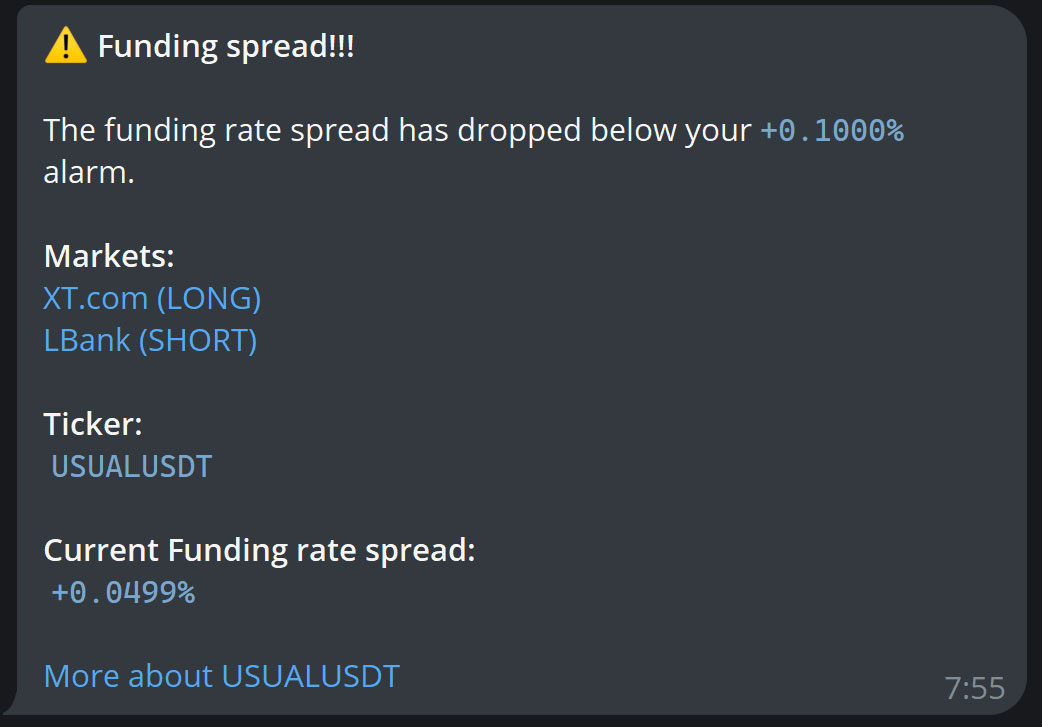

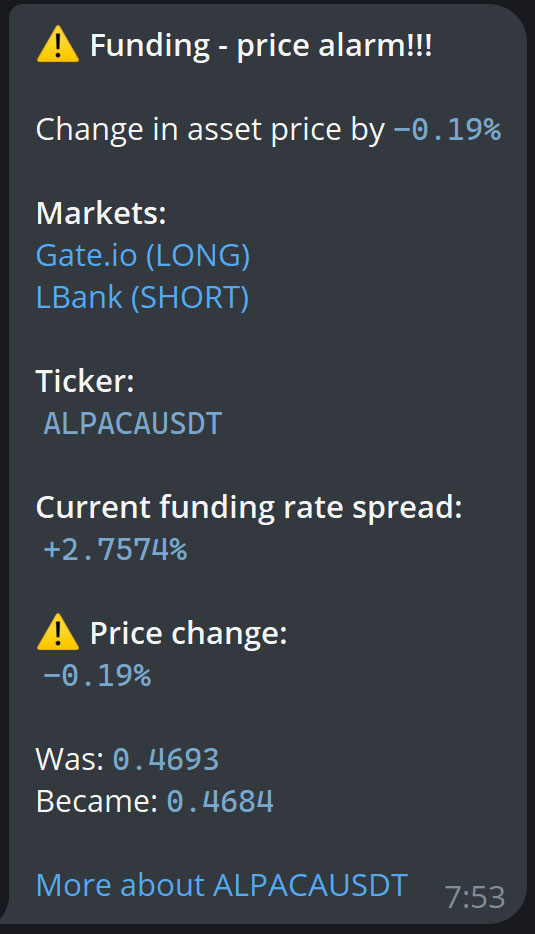

Telegram Notifications on Asset Price and Spread Changes

Users can also configure Telegram notifications to monitor significant asset price swings or changes in the funding spread. Real-time alerts inform you immediately when the funding spread turns unfavorable or when asset prices shift dramatically, helping you promptly rebalance your positions and prevent potential losses.

The P2P.Army Funding Rate Scanner makes life significantly easier for crypto arbitrageurs. It allows traders to quickly discover profitable arbitrage opportunities, remain alert and proactive toward changing market conditions, and effectively manage risk.