DEX/CEX cryptocurrency arbitrage

Crypto arbitrage between DEX and CEX exchanges with Telegram notifications

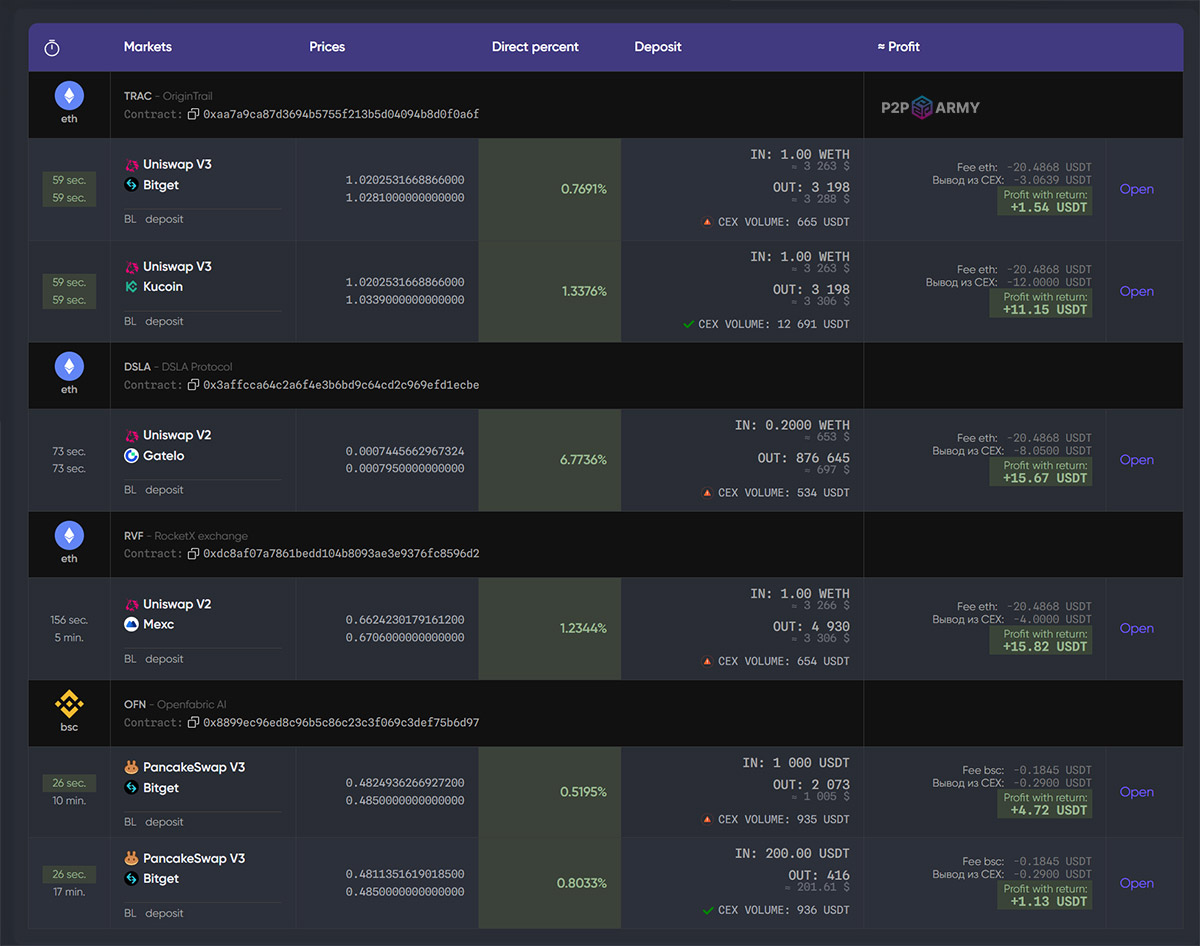

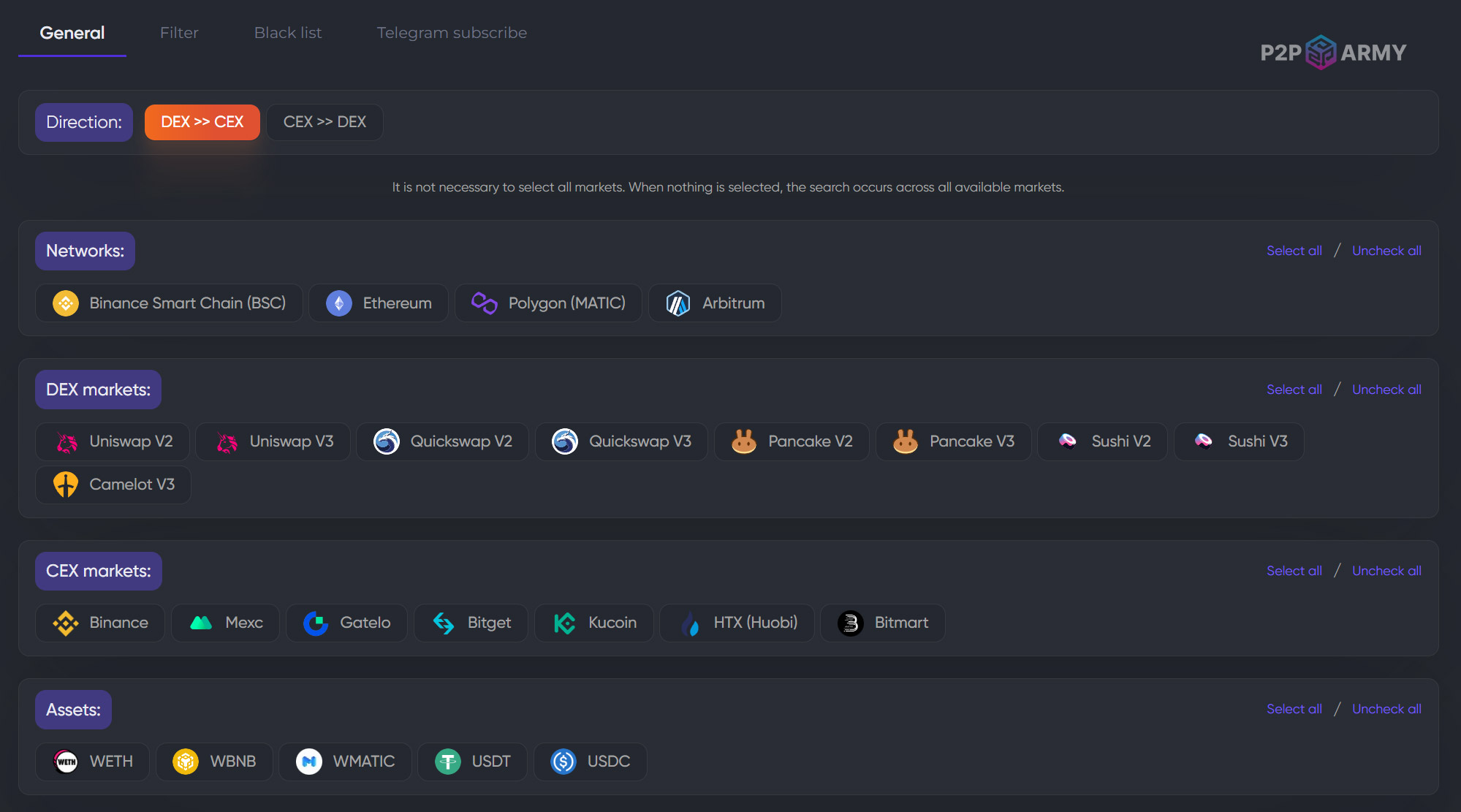

DEX Scanner Features

7+ CEX exchanges

9+ DEX exchanges

More than 5000 DEX pools

4 blockchains

All contracts are checked for security, honeypot, hidden commissions.

High-quality synchronization with CEX exchanges

Statistics for last 24 hours

Possible amount of earnings in 24 hours if you close all spreads using P2P.Army signals, taking into account all commissions.

The number of positive signals in 24 hours that our system recorded.

Statistics for the last 24 hours by network

Disclaimer

DEX/CEX arbitration carries high risks! To successfully work with inter-exchange arbitrage, you need deep knowledge of trading, an understanding of the order book, orders, blockchain networks, CEX exchanges, DEX exchanges, and a high concentration of attention.

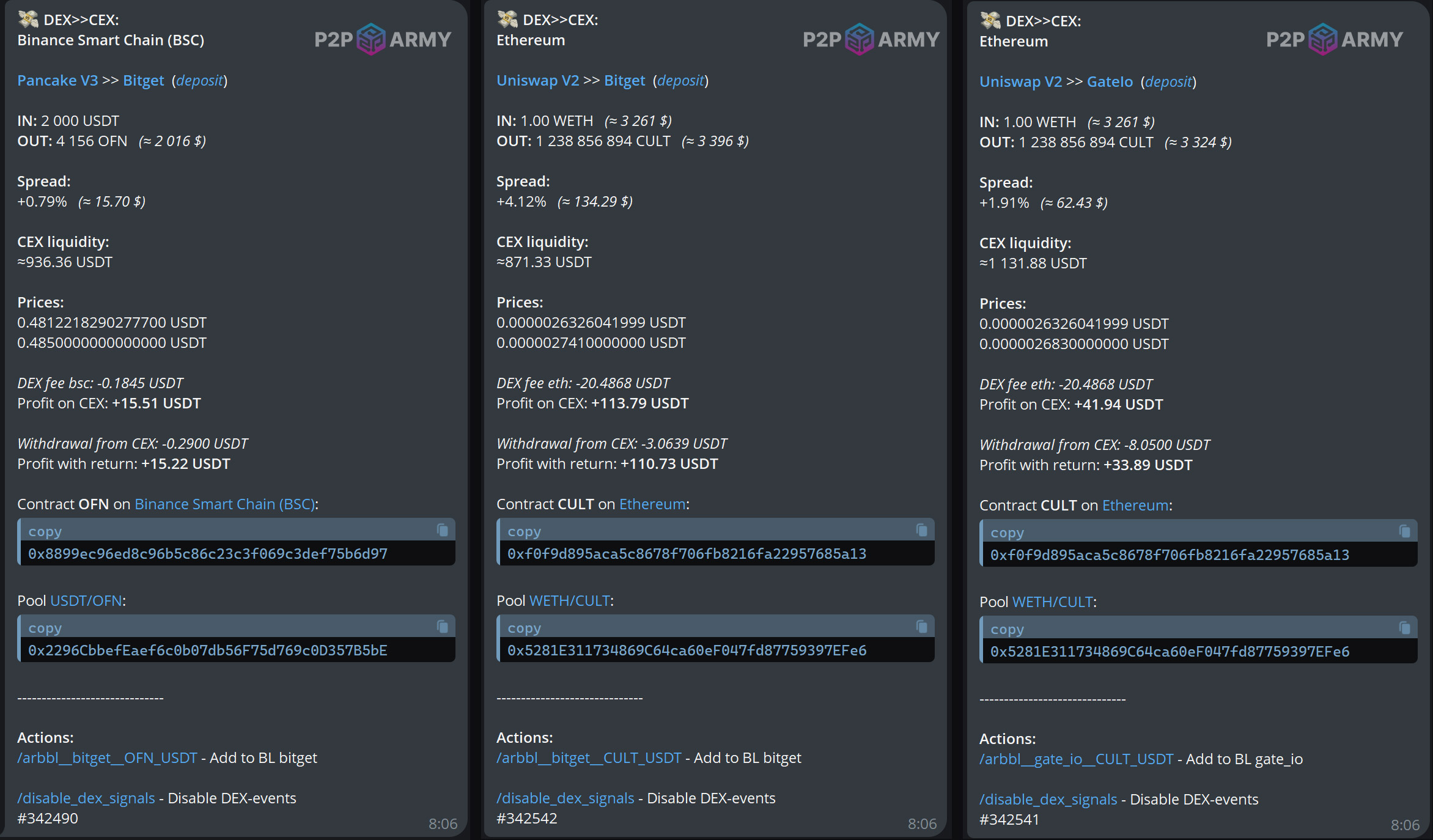

All arbitration opportunities that the system offers you were generated automatically without human verification! Therefore, additional verification of each of your transactions is required!

In case of loss of your funds, P2P.Army does not bear any responsibility! P2P.Army offers only analytical information, which must be double-checked. The tool can be used with both positive and negative results.

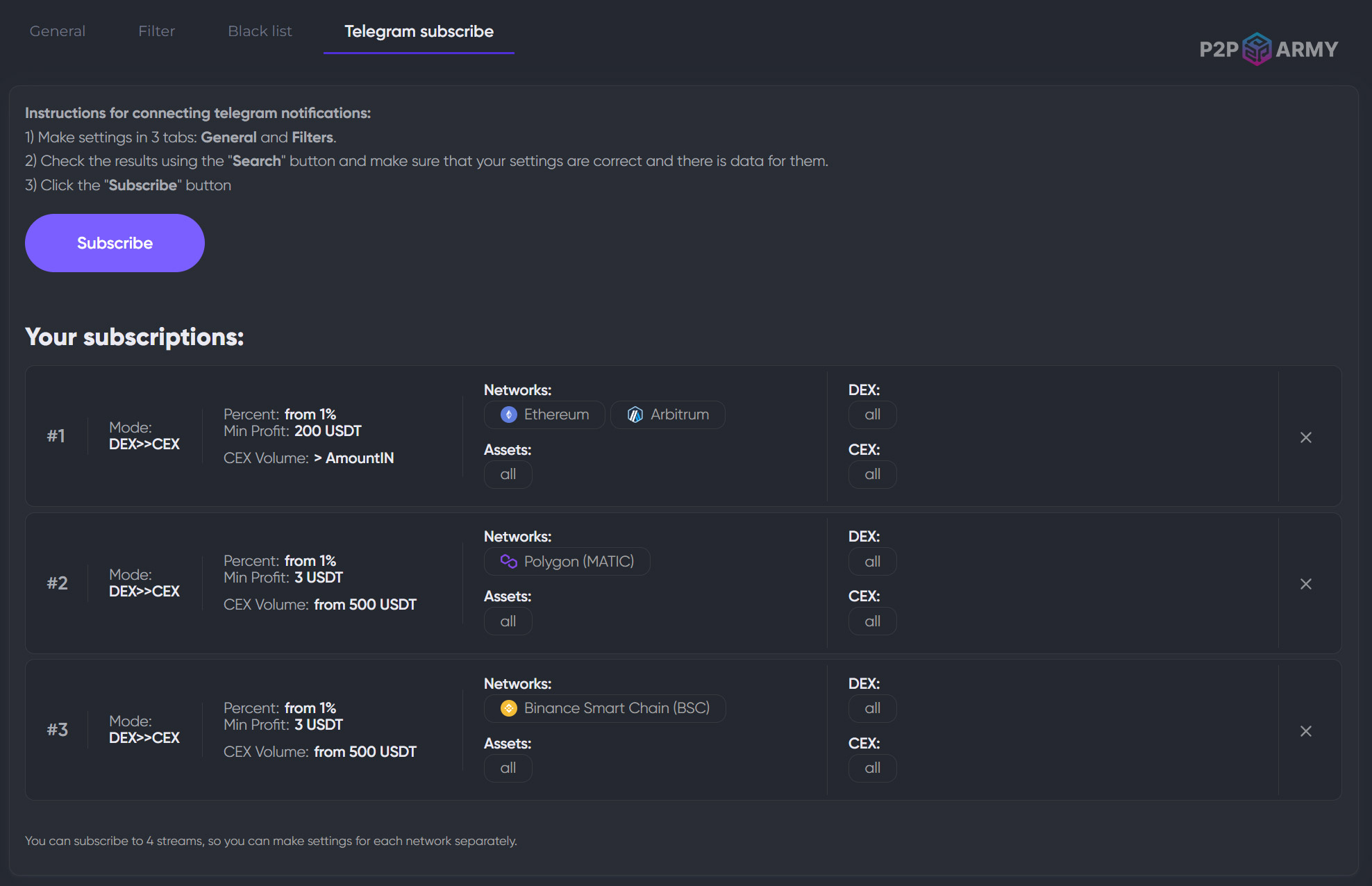

Screenshots of DEX signals

Are you ready?

To access this functionality, you need to subscribe to a PREMIUM tariff.