USD Stablecoin Arbitrage

Real-time Monitoring with Telegram Alerts

Why Stablecoins Prices Matter on the Crypto Market?

Stablecoins are digital assets designed to minimize the inherent volatility of cryptocurrencies. Most popular USD-pegged stablecoins, such as USDT (Tether), USDC (USD Coin), DAI and FDUSD, maintain a pegged exchange rate of 1:1 with the U.S. dollar.

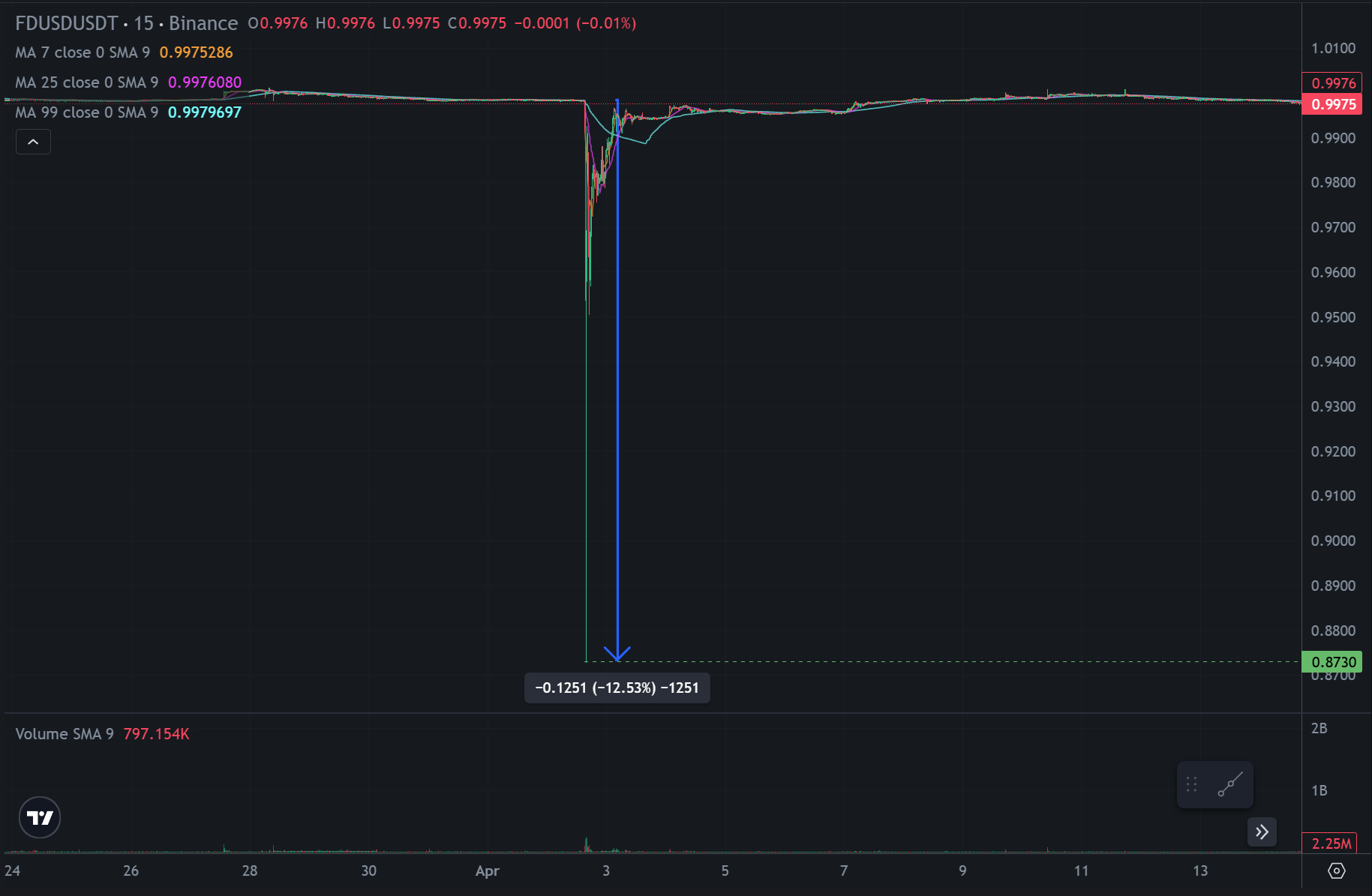

Despite promising stability, short-term deviations from the 1:1 peg frequently occur. These deviations may be triggered by:

- Sharp increases in trading volume during market volatility

- Technical disruptions on crypto exchanges

- Underlying financial instability involving the issuer institution

- Regulatory announcements or market rumors

Such momentary price deviations can become an opportunity for profitable arbitrage trading. However, manually tracking and responding timely can often be difficult.

About P2P.Army's Stablecoin Monitoring Tool

The team at P2P.Army developed an advanced solution to automatically and instantly track critical deviations in USD stablecoin prices across major crypto exchanges. This dedicated monitoring system uses cutting-edge algorithms for 24/7 real-time surveillance.

Main Features:

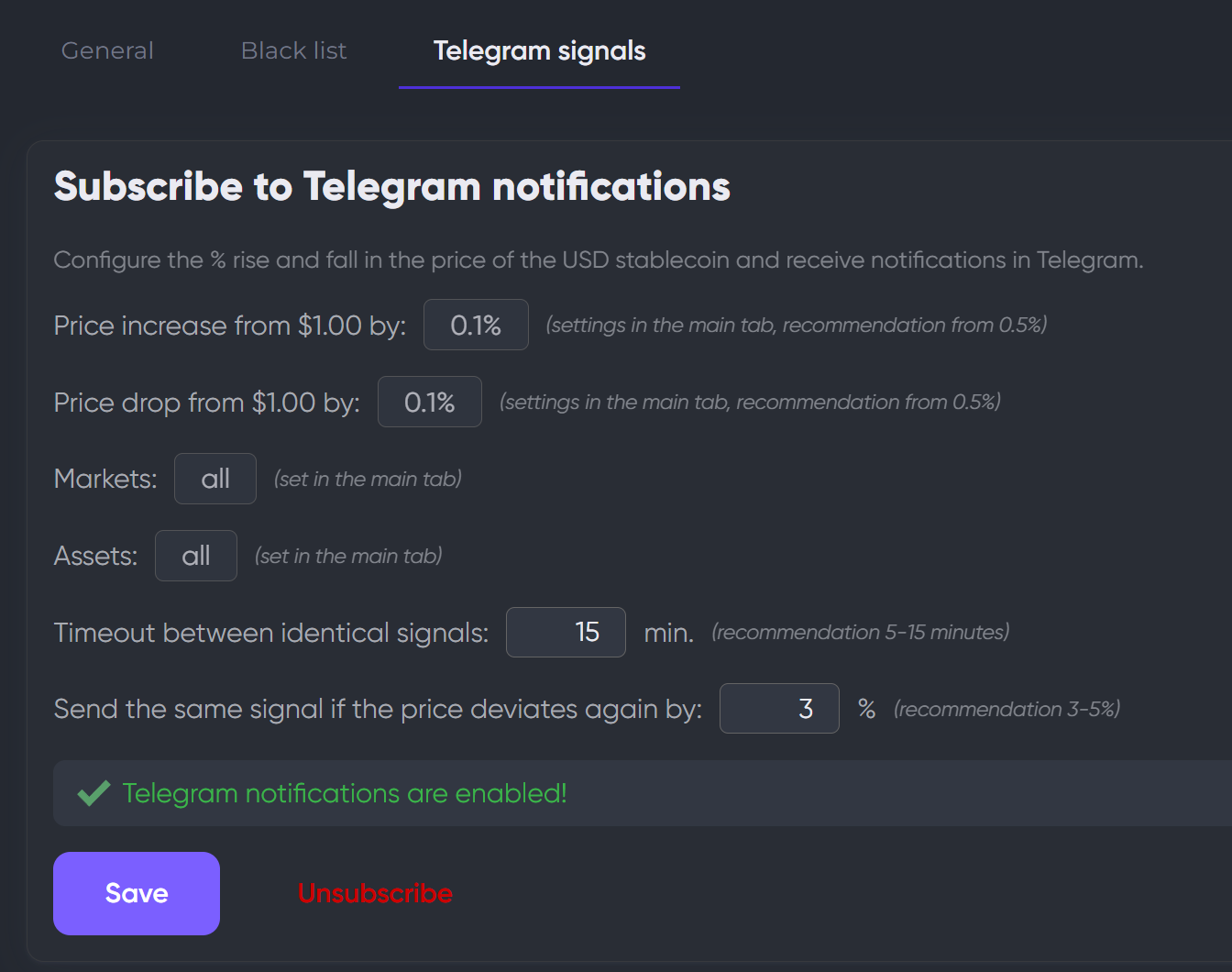

- Instant Telegram alerts: When stablecoin prices fluctuate beyond predefined thresholds, users receive immediate notifications via Telegram.

- Customizable parameters: Users select preferred exchanges, stablecoins, and set their own deviation thresholds for alerts.

User Benefits of P2P.Army's Monitoring Solution

- Market advantage: Early alerts ensure you stay ahead of market participants, allowing strategic, timely decisions.

- Time savings and automation: Eliminate the need to manually monitor multiple exchanges, as real-time monitoring runs automatically and effortlessly.

Who Should Use This Stablecoin Monitoring Tool?

This automation tool is particularly useful for:

- Arbitrage traders seeking quick profits by exploiting short-term discrepancies between exchanges.

- Long-term investors holding significant positions in stablecoins and aiming to profit when prices eventually re-stabilize, leveraging high liquidity for potentially large-scale trades.

- General crypto users, allowing quick identification and reaction to potential de-pegging risks.

- P2P traders, who depend on precise stablecoin pricing data for fast and informed OTC deals.

How to Profit from Stablecoin Price Deviations?

Several strategies exist to profit when stablecoins lose their dollar-pegged stability:

- Arbitrage: Exploit price differences across multiple exchanges by buying low on one exchange and selling high on another.

- Short-term speculation: Buying discounted stablecoins in anticipation of price recovery to parity.

- Long-term holding: If strongly convinced prices will return to the peg, holding stablecoins might generate gains over extended periods.

- DeFi liquidity providing: Provide liquidity to decentralized exchange pools or lending protocols, earning transaction fees in the process.

- Futures and options: Leverage high volatility via futures or options to speculate and earn from stablecoin price movements.

Getting Started with the P2P.Army Stablecoin Monitoring Tool

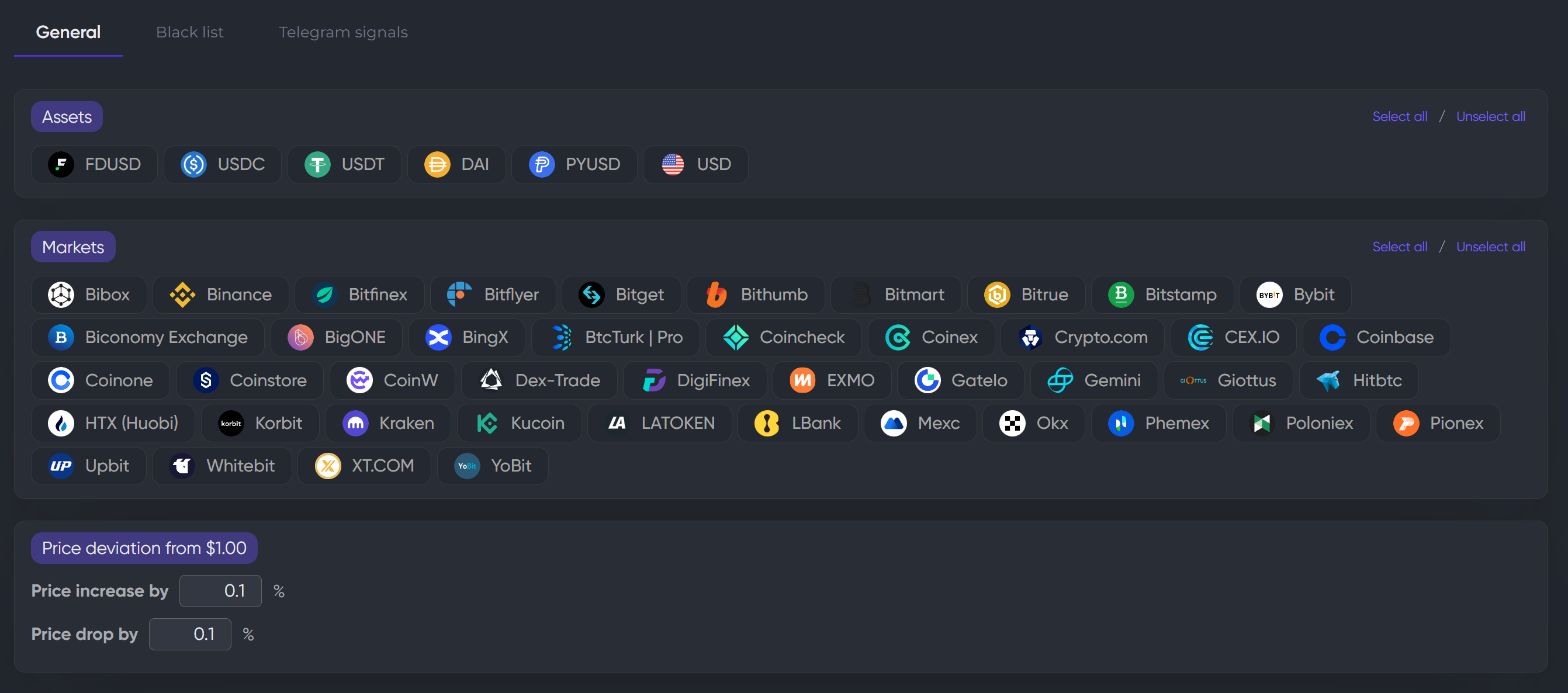

Using the monitoring tool is straightforward and intuitive:

- Create an account on the P2P.Army platform.

- Select the USD stablecoins and exchanges you wish to track.

- Set custom price deviation alerts to your preferences.

- Sit back and let the service automatically notify you instantly via Telegram when thresholds are crossed, allowing immediate decision-making.

Conclusion

The automatic, real-time USD stablecoin monitoring solution provided by P2P.Army offers crypto traders and investors a crucial advantage: the ability to detect and exploit price discrepancies rapidly. This tool enhances profitability through informed decision-making while significantly reducing trading risks.

Stay ahead and trade smarter with P2P.Army’s stablecoin monitoring system—gain continuous access to profitable arbitrage opportunities around the clock!

Access

To access this functionality, you need to subscribe to a DEX/CEX plan.